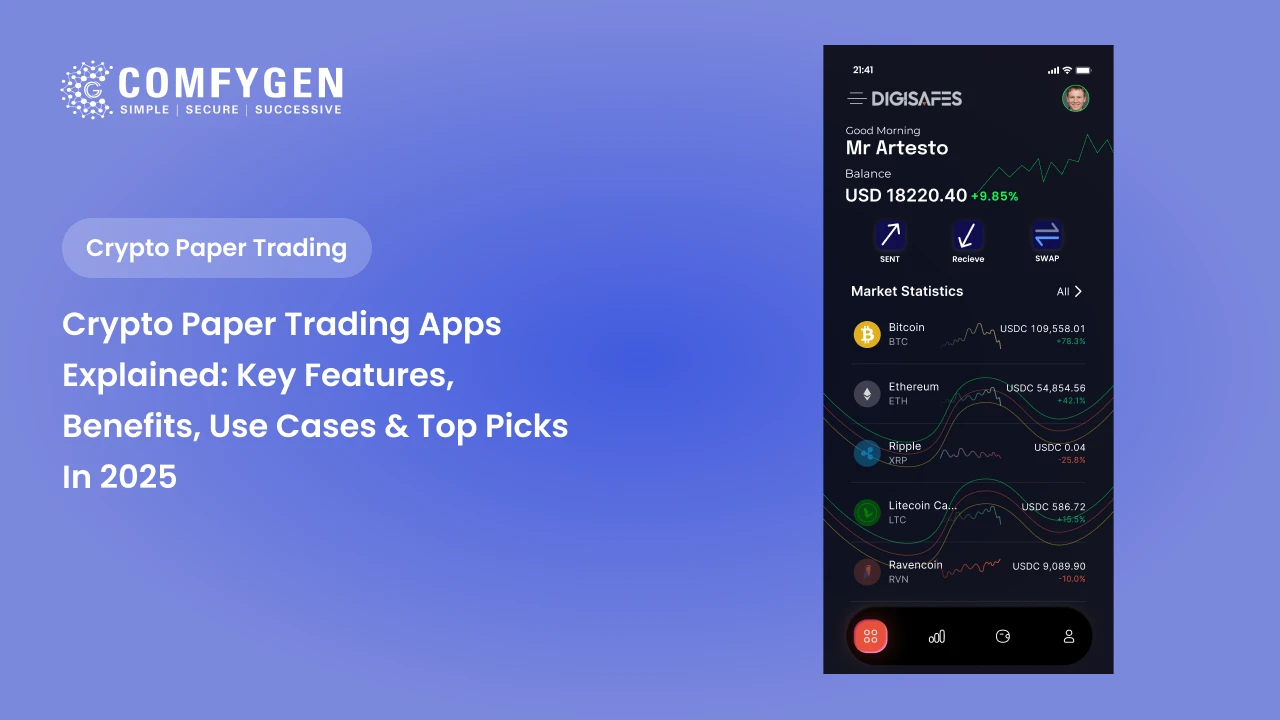

Crypto Paper Trading Apps Explained: Key Features, Benefits, Use Cases & Top Picks in 2025

Crypto paper trading allows users to simulate real-market trades using virtual funds. It is basically a risk-free environment where you can practice buying, selling, and managing a portfolio like you trade real capital, without fear of losing money.

You’re a beginner who wants to know how markets work or an experienced trader testing a new strategy; Crypto paper trading is an essential tool. It gives you the freedom to make mistakes, learn from them, and refine your approach before entering the real market. Even seasoned traders use paper trading to experiment with different techniques or to test algorithmic strategies under real-time conditions.

In 2025, crypto paper trading platforms will have become smarter and more advanced. Many now offer realistic market simulations, AI-powered strategy suggestions, automated bots, and integrations with multiple crypto exchanges. These innovations make paper trading more valuable than ever—not just as a learning tool, but as a key part of any trader’s toolkit.

In this blog, we’ll explain what crypto paper trading apps are, highlight the key features to look for, discuss their many benefits and use cases, and round it all out with our top picks for the best paper trading platforms in 2025.

What is Crypto Paper Trading?

A crypto paper trading platform, also known as a cryptocurrency demo trading or virtual crypto trading platform, is a risk-free method to practice crypto investing and trading strategies using simulated money for beginners. It looks like the real-time crypto market environment without requiring you to risk any actual funds, making it an essential tool for both beginners and experienced traders.

Definition and Purpose of Crypto Paper Trading

Crypto paper trading is a simulation of real-world trading where users can buy and sell cryptocurrencies using virtual currency. The purpose is to allow users to learn crypto trading or test crypto trading strategies without the emotional pressure or financial risk that comes with live trading. It’s a safe way to gain experience with price fluctuations, order execution, and portfolio management.

How Crypto Paper Trading Works

Crypto paper trading platforms provide users with a simulated account funded with virtual crypto tokens or dollars. These platforms track live market data from top cryptocurrency exchanges such as Binance, Coinbase, or Kraken, allowing users to:

-

Place market, limit, or stop-loss orders

-

Monitor price charts and technical indicators

-

Build and rebalance a simulated crypto portfolio

Key Features of Crypto Paper Trading Apps

Choosing the right crypto paper trading platform can significantly improve your learning and strategy of crypto trading. In 2025, crypto trading tools will have evolved beyond basic simulations. The best crypto demo trading apps now offer powerful features that create real-world trading environments. Below are the most essential features to look for when evaluating a cryptocurrency virtual trading app:

1. Real-Time Market Data Integration

One of the most critical features of any reliable crypto demo trading platform is access to live crypto price feeds. Real-time data allows you to trade based on actual market movements, just as you would with real money.

2. Simulated Portfolio Management

Top crypto paper trading apps offer comprehensive virtual portfolio tracking features. These let you manage a simulated balance, place trades, and monitor your profit and loss (P&L) just like in a real account.

3. Advanced Technical Analysis Tools

A good trading simulator will come with built-in charting tools, technical indicators, and drawing functionalities. These tools allow traders to practice reading charts and making data-driven decisions.

4. Strategy Testing & Backtesting

Many advanced platforms in 2025 offer backtesting tools to run your trading strategies against historical data. Others allow you to test strategies live with virtual funds before going live.

5. Customizable Dashboards

Each trader has a unique style and workflow. The best crypto simulation platforms let you personalize your trading interface to fit your needs—whether you’re a scalper, swing trader, or investor.

6. Mobile & Desktop Compatibility

In 2025, top paper trading platforms are optimized for both mobile apps and desktop browsers, ensuring you can practice trading from anywhere.

7. Community & Social Trading Features

Some crypto demo platforms include social trading tools, where users can follow top paper traders, view public portfolios, or join trading challenges.

8. AI & Automation Tools (2025-Specific)

In 2025, many platforms will integrate AI-powered crypto trading assistants and simulated trading bots. These help users explore automated strategies without risking real money.

Need Custom Solutions

for Your Crypto Trading App?

Contact Now

Benefits of Using Crypto Paper Trading Apps

Using a crypto paper trading app offers numerous advantages for traders at all levels, especially in the fast-paced, unpredictable world of cryptocurrency. Whether you’re a beginner trying to understand how crypto works or an experienced trader testing a new strategy, paper trading crypto gives you a powerful, risk-free environment to grow your skills and confidence.

Risk-Free Learning

The biggest advantage of using a crypto paper trading app is that it provides a risk-free environment. Users can practice as much as they want without the fear of losing money, allowing them to build confidence and learn from their mistakes.

Skill Development

Paper trading apps give users the chance to develop essential trading skills such as analyzing price charts, executing trades, managing portfolios, and understanding market trends.

Strategy Testing

Traders can experiment with different strategies, including day trading, swing trading, and long-term investment strategies, to see which works best for them. This helps in refining approaches and building a solid trading plan.

Emotional Control

Live trading often leads to emotional reactions like fear, greed, and panic, which can result in poor decisions. Paper trading, on the other hand, allows traders to practice without the emotional pressure of real money on the line.

No Financial Risk

Since you’re trading with virtual money, you don’t risk losing any actual funds, making it a perfect environment for beginners to practice without financial worries.

Market Familiarity

For those who are new to crypto trading, paper trading offers an opportunity to get familiar with market conditions, exchange interfaces, and trading tools before making actual trades in live markets.

Top Crypto Paper Trading Apps in 2025

With the rapid evolution of cryptocurrency markets, today’s crypto paper trading apps are no longer just basic simulators. The best crypto paper trading platforms in 2025 now offer real-time execution, AI-powered crypto trading bots, multi-exchange integration, and cross-device support. Whether you’re a beginner learning the ropes or a pro testing a new algorithm, choosing the right tool can significantly impact your growth.

1. TradingView Paper Trading

TradingView is a leading platform for real-time charting and technical analysis. It’s built-in paper trading mode lets users place simulated trades directly from the chart interface. It connects to real-time price data from major cryptocurrency exchanges, enabling you to test strategies based on live market conditions.

Pros:

-

Industry-leading charting tools and indicators

-

Supports hundreds of crypto pairs

-

Clean, intuitive interface

-

Free plan available

Cons:

-

No multi-exchange account simulation

-

Lacks advanced bot integration

2. Crypto Parrot

Crypto Parrot is a user-friendly paper trading simulator that uses a gamified approach to help beginners learn how to trade cryptocurrencies. It offers virtual crypto trading competitions, real-time market simulations, and a simple interface ideal for those just getting started.

Pros:

-

Fun, educational environment

-

Great for understanding basic trading concepts

-

Compete with other users in virtual trading contests

Cons:

-

Not suitable for advanced strategy testing

-

Limited charting and technical analysis tools

3. Binance Mock Trading (Binance Testnet)

Binance, the world’s largest crypto exchange, offers a Testnet for its Spot, Futures, and Options platforms, enabling users to practice trading on a simulated version of its live interface. It’s ideal for users who plan to use Binance for real trading.

Pros:

-

Identical UI to the live Binance platform

-

Supports mock Spot and Futures trading

-

Great for learning Binance’s interface

Cons:

-

Requires Testnet setup (somewhat technical)

-

Not ideal for casual traders or beginners

4. Bitsgap Demo Mode

Bitsgap is known for its crypto trading bot platform, and its demo mode lets you simulate automated strategies across multiple exchanges like Binance, Kraken, and Coinbase. It’s a solid choice for those experimenting with grid bots, DCA bots, and arbitrage strategies.

Pros:

-

Simulate multiple automated trading bots

-

Works across various exchanges

-

Clean, unified dashboard

Cons:

-

Paid subscription required for full features

-

More suitable for intermediate to advanced users

5. CoinMarketGame (Honorable Mention)

CoinMarketGame is a free, gamified platform that allows users to simulate buying and selling cryptocurrencies in a simplified environment. It doesn’t offer advanced tools, but it’s ideal for individuals who want to learn the basics of trading mechanics.

Pros:

-

Completely free

-

No account or wallet needed

-

Beginner-friendly and fun

Cons:

-

No technical indicators or charting

-

Not suitable for serious strategy testing

Advanced Strategies for Using Crypto Paper Trading Apps

1. Algorithmic Trading Simulations

Algorithmic trading involves using automated systems to execute trades based on pre-defined criteria. Paper trading apps allow users to test these strategies using historical data before deploying them in a live market.

2. High-Frequency Trading (HFT) Practice

Paper trading apps allow for the simulation of high-frequency trading (HFT), a technique that involves executing numerous trades in a short time frame to capitalize on small price changes. This helps users practice with large volumes of trades and fast execution.

3. Leveraged Trading Simulation

Paper trading apps are ideal for practicing leveraged trading, where users borrow funds to increase the size of their trades. This strategy comes with high risks, and testing it in a virtual environment can help users understand its potential rewards and dangers.

Create Your Own

Risk-Free Trading App

Contact Now

Final Thoughts

Crypto paper trading apps offer an invaluable learning platform for anyone interested in crypto trading. By providing a risk-free, simulation-based environment, these apps help traders build essential skills, practice strategies, and understand the intricacies of the cryptocurrency markets.

While these platforms are an excellent tool, they should never replace a live trading experience. The true challenge of crypto trading comes with managing risk and emotions in live market conditions. However, by starting with paper trading, you can gain the knowledge and confidence needed to succeed.

Whether you’re a beginner trying to understand the basics or an experienced trader looking to refine your strategy, crypto paper trading apps can be the stepping stone to becoming a skilled and successful trader.

Frequently Asked Questions (FAQs)

What is a Crypto Paper Trading App?

A crypto paper trading app is a tool that allows users to trade cryptocurrencies in a simulated environment using virtual money. It mimics real trading conditions and offers a risk-free platform for beginners to learn and practice crypto trading strategies without the fear of losing actual funds.

Why Should I Use a Crypto Paper Trading App?

Crypto paper trading apps are ideal for beginners who want to learn the basics of crypto trading or experienced traders who want to test new strategies without financial risk. These apps help you build confidence, develop trading skills, and understand market dynamics before risking real money.

Are Crypto Paper Trading Apps Free to Use?

Yes, most crypto paper trading apps are free to use. However, some apps may require you to create an account to access their demo features, while premium features or additional tools might come with a cost.

Can I Trade Real Cryptocurrencies on a Paper Trading App?

No, you cannot trade real cryptocurrencies on a paper trading app. These platforms provide virtual currencies to simulate the trading experience, which means no actual crypto is bought or sold.

Do Crypto Paper Trading Apps Provide Real-Time Market Data?

Yes, most crypto paper trading apps provide real-time or near real-time market data, ensuring that your trades mimic real market conditions. This helps you practice trading with the same market volatility that you would face in a live trading environment.

How Does Crypto Paper Trading Help Improve My Skills?

Crypto paper trading helps you practice different strategies, understand technical analysis, manage risk, and learn the trading platform without financial risk. It allows you to make mistakes and learn from them without the stress of losing real money.

Can I Transition from Paper Trading to Live Trading?

Yes, once you feel confident with your skills, you can transition from paper trading to live trading. However, it’s important to remember that real trading involves emotions, risks, and market unpredictability, which paper trading does not fully simulate.

What Are the Key Features of a Good Crypto Paper Trading App?

A good crypto paper trading app should offer:

-

Real-time market data

-

Various trading order types (limit, market, stop-loss)

-

Simulated trading environment with virtual funds

-

Performance tracking and analytics

-

Educational resources and tutorials for beginners

Are Crypto Paper Trading Apps Suitable for Beginners?

Yes, crypto paper trading apps are excellent for beginners. They offer a risk-free platform to learn trading concepts, understand crypto market mechanics, and test strategies without the fear of losing money.

Can I Use Paper Trading to Test Advanced Trading Strategies?

Yes, paper trading is ideal for testing advanced strategies like day trading, swing trading, or algorithmic trading. You can experiment with different risk management techniques, leverage, and other advanced methods without putting real money on the line.

Mr. Saddam Husen, (CTO)

Mr. Saddam Husen, CTO at Comfygen, is a renowned Blockchain expert and IT consultant with extensive experience in blockchain development, crypto wallets, DeFi, ICOs, and smart contracts. Passionate about digital transformation, he helps businesses harness blockchain technology’s potential, driving innovation and enhancing IT infrastructure for global success.