In constantly changing funding surroundings, actual international assets (RWA) have emerged as increasingly attractive. These cloth, bodily belongings, which encompass infrastructure, commodities, and real estate, have special benefits for investors looking for growth, stability, and diversification over the long term. The purpose of this investigation into “Why and How to Invest in Real World Assets” is to perceive the sturdy factors influencing the growing interest in RWAs.

RWAs are critical to the renovation and increase of wealth due to the fact they offer quite a few blessings, consisting of portfolio diversification, consistent profit streams, and inflation protection. With an emphasis on the approaches and elements that have an impact on RWA investments, this manual seeks to arm traders with the statistics they need to negotiate this ever-changing market correctly.

What is Real World Assets (RWA)?

Unlike simply monetary or digital entities, real-global assets (RWA) are tangible, bodily belongings with inherent fees within the real globe. A wide type of belongings, such as infrastructure, commodities, and real property, fall beneath this category. RWAs are attractive as tangible investments because of their physical presence and mobile application development services, which provide them with cost.

Start Your RWA Investment Journey Today!

RWAs are attractive to traders because they can produce regular income, act as a hedge in opposition to inflation, offer stability, and assist in long-term portfolio increases. The word emphasizes a pass far away from completely monetary gadgets and closer to belongings with a bodily foundation, indicating an extra comprehensive technique to investing strategies that take tangible, actual-global value into consideration.

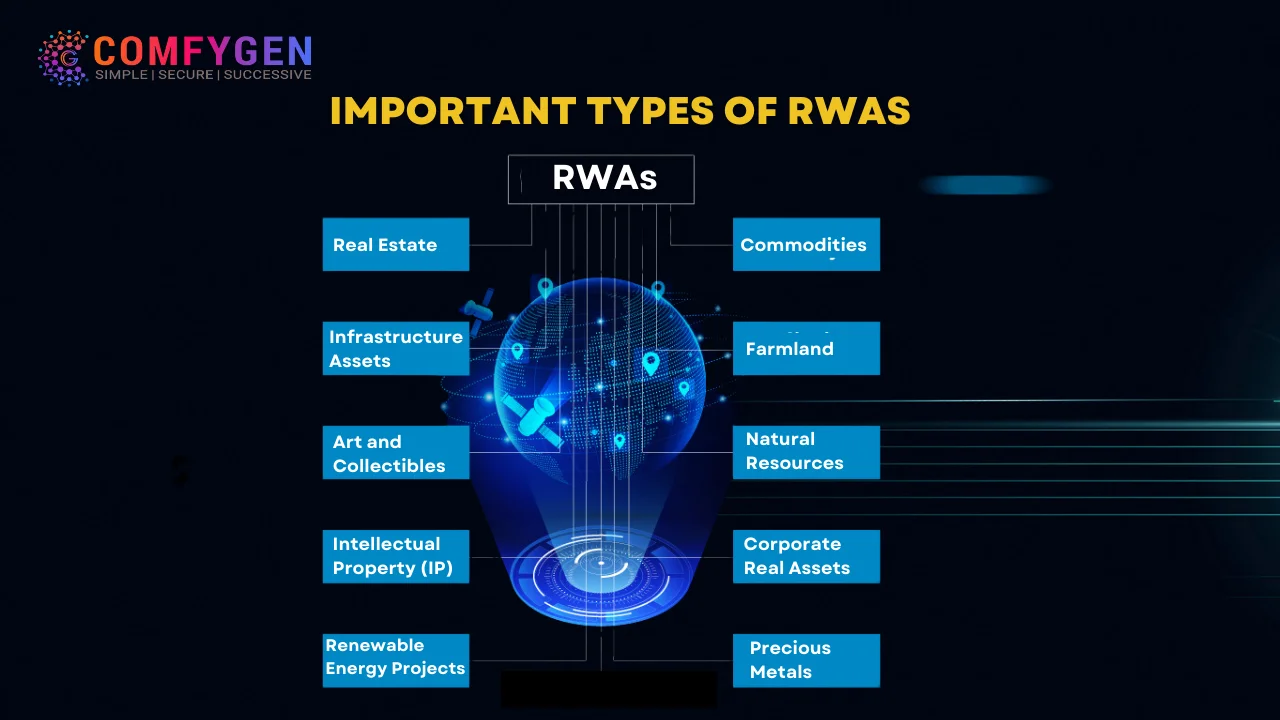

Important Types of RWAs

Real World Assets are a broad category of material and physical assets that have an inherent value derived from the real world. Purchasing RWAs gives investors chances for long-term growth, income generation, and stability. The following are a few significant RWA types:

Real Estate

One of the most commonplace categories of RWAs is real property. Commercial, commercial, and home residences fall beneath this category. Real estate is a famous preference amongst buyers due to its capability for inflation safety, condo profits, and appreciation. Another option to put money into actual property without definitely proudly owning any residences is through actual property funding trusts or REITs.

Commodities

Physical items like gold, silver, oil, or agricultural merchandise are examples of commodities. Commodity-making an investment promotes diversification and serves as an inflation hedge. Exchange-traded fee range (ETFs), mutual budget with a focal point on commodities, and direct possession are some approaches to which investors can get exposure to commodities.

Infrastructure Assets

This category includes financial commitments made to the construction of necessary physical facilities like utilities, roads, bridges, and airports. Infrastructure investments yield steady, long-term returns, which are often sponsored by way of authorities’ contracts or managed revenue sources. In addition to promoting financial app development increases, infrastructure projects can offer traders engaging risk-adjusted returns.

Precious Metals

Due to their scarcity and sensible programs in the industry, treasured metals, including gold, silver, platinum, and palladium are prized. Precious metals are popular among investors as a hedge in opposition to monetary uncertainty and a store of fees. Investing in precious steel mining stocks or keeping physical metals are famous approaches to taking part in this RWA class.

Art and Collectibles

Art and collectibles are cloth possessions with inherent real worth. Investing in collectibles along with uncommon cash, vintage automobiles, great art, or other items is an option for traders. These assets benefit cost through the years, which attracts traders looking for non-conventional monetary gadgets as alternative investments.

Natural Resources

Timber, water rights, and agricultural land are examples of property that can be invested in. For instance, timberland gives possibilities for investments in sustainable forestry. Investing in water rights, which can entail leasing or proudly owning water sources, is becoming more important in addressing concerns about water scarcity.

Farmland

Purchasing and overseeing agricultural land is part of farmland investments. Exposure to the agricultural industry via this form of RWA allows buyers to make the most of both capability land appreciation and the arena’s developing call for food development services. One manner to invest in farmland is to lease it to agricultural operators.

Corporate Real Assets

These are the tangible assets like manufacturing facilities, warehouses, or office buildings that businesses own and function. Exposure to the real property that energy business operations are afforded by means of making an investment in certified returnable belongings, which can also encompass sale-leaseback agreements wherein a business sells its real property and then rents it again.

Intellectual Property (IP)

An intangible asset that is monetizable is represented with the aid of highbrow belongings, which include copyrights, emblems, and patents. Investors can take part in price ranges or securities backed by intellectual assets, and they could profit from income from highbrow property rights, royalties, or licensing agreements.

Renewable Energy Projects

Funding sun or wind farms is one manner to invest in renewable energy tasks. These projects, which are regularly subsidized through lengthy-term power buy agreements, offer buyers strong and predictable returns while also helping them obtain sustainability desires.

How Real-World Assets (RWAs) Work?

Real World Assets are a category of investments that are primarily based not on summary economic devices but on real, physical belongings. These resources include commodities, real estate, infrastructure, and herbal sources, amongst other things. Investigating the inner workings of these concrete investments and the forces that propel their fulfillment is critical to comprehending how RWAs perform.

Real-World Asset Categories

Real property, infrastructure, and commodities are the three most important classes into which RWAs fall. Real estate consists of the possession and administration of tangible belongings, consisting of houses or commercial systems. Projects along with utilities, energy facilities, roads, and bridges are the focus of infrastructure investments. Tangible items, including energy assets, agricultural products, and precious metals, are examples of commodities.

Diversification Techniques

One of the most important RWA investing techniques is diversification. By diversifying their investments among various real-world asset classes, investors can reduce the risks connected with a particular sector or location. A diversified portfolio can be produced, for example, by fusing real estate holdings with investments in commodities or infrastructure projects. This strategy aids in mitigating the effects of unfavorable occurrences in a particular industry or market.

Physical Tangibility and Intrinsic Value

RWAs are fundamentally different from financial assets in that they have intrinsic value. RWAs are associated with physical properties, unlike stocks or bonds, which signify ownership or debt but have no physical counterpart. For example, a real estate property’s location, condition, and market demand all affect its value. Because of their tangible quality, which adds a layer of stability and security, RWAs appeal to investors looking for assets with inherent value.

Market Dynamics and Economic Influences

Market dynamics and economic factors have a significant impact on RWA performance. Demand for properties, population trends, and local economic indicators are important factors in real estate. On the other hand, public-private partnerships, government policies, and broader economic conditions. Macroeconomic patterns, geopolitical developments, and worldwide supply and demand all affect commodities like gold and agricultural products.

Real World Assets and Private Equity

The RWA landscape is significantly influenced by private equity. Private equity funds that concentrate on big projects give investors access to real assets. These funds combine the money of different investors to fund initiatives like building infrastructure or investing in real estate. Access to a variety of RWA portfolios and opportunities to work on projects that might be difficult for an individual to take on are provided by private equity.

Risk and Return Considerations

RWAs have inherent dangers, just like other forms of investment. The cost of these assets may be impacted by means of adjustments inside the market, modifications in rules, and downturns in the economy. In contrast to economic belongings, RWAs’ tangible nature often offers a little insulation. For example, real property typically studies lower volatility than shares. Risk evaluation and management are critical, and investors ought to carry out big due diligence to understand the unique dangers related to each kind of RWA.

Hedging Against Inflation

RWAs are often regarded as a hedge against inflation, in particular on the subject of commodities like gold and silver. Because tangible goods generally tend to grow at a rate as inflation increases, having assets with intrinsic fees can help defend wealth. To mitigate the impact of inflation on the general price of their investments, investors might also allocate a portion of their portfolio to commodities.

Why Invest in Real World Assets?

Investing in bodily belongings affords a concrete and frequently dependable manner of earnings generation, wealth preservation, and portfolio diversification. A big array of exact homes, which includes real property, infrastructure, commodities, and herbal assets, are protected inside the category of real belongings.

In addition to capitalizing on the increasing worldwide populace and acting as a hedge against inflation, this form of funding has unique advantages over extra conventional monetary belongings like stocks and bonds. The motivations for each person and institutional trader to choose to spend money on real international belongings could be protected in this talk.

Tangible and Intrinsic Value

Real assets have intrinsic value; financial instruments that depend on market perceptions do not. Real estate, commodities, and infrastructure are examples of tangible properties that have physical substance and are useful. They provide investments with security and stability. Their inherent value emphasizes their value regardless of market sentiment. This distinguishes them, giving them a feeling of stability and fortitude.

Portfolio diversification and risk mitigation

Real assets offer a useful method for diversifying a portfolio. Their capability to decrease general danger is substantially more advantageous by way of their traditionally low correlation with more conventional financial assets like stocks and bonds. Investors build a buffer towards marketplace volatility by means of adding actual global assets, which promotes a higher and more resilient investment portfolio.

Inflation Hedge

Real belongings, especially real estate, and commodities, serve as a built-in inflation hedge. This property’s tangible high quality allows them to appreciate in fee over the years, protect wealth, and act as a trustworthy keep of cost while prices are upwardly thrust. Their inherent ability to counteract the depressing influences of inflation makes them more appealing to investors who are seeking to hold their wealth over the long run.

Global Population Growth

As the world’s population continues to push upward, there is a growing need for primary components like food, energy, and housing. Real-world belongings stand to advantage a wonderful deal from this demographic trend, in particular the ones associated with infrastructure and necessities. Investing in step with the needs of the world’s increasing populace offers strategic lengthy-time period increase possibilities.

Income Generation

The capacity of real-global belongings to provide regular streams of income is one of their main advantages. While infrastructure assets may generate constant coin flows through tolls or charges, real property investments have the potential to generate condominium earnings. This consistent income will become a reliable supply of coins to go with the flow, particularly in uncertain economic times, whilst different sources of income might be threatened.

Tangible Usefulness and Demand

Real assets fulfill necessary functions in society and have a practical role. These assets, which range from commercial and residential buildings to natural resources and agricultural land, satisfy basic human needs. The concrete utility of these assets guarantees continued demand. Real asset investments are still relevant and valuable as long as society needs these resources.

Long-Term Appreciation

Historical facts have shown that actual belongings, mainly actual estate, have a tendency to be realized over the years. The underlying value of these properties has a tendency to rise regardless of temporary fluctuations. The potential for a lengthy-time period capital boom is in line with the targets of traders who want to construct wealth and enjoy a steady boom.

Infrastructure Investment

Investing in infrastructure, which incorporates things like utilities, roads, and bridges, no longer promotes economic increase but additionally yields regular returns. Long-term contracts or authorities’ agreements are commonplace in infrastructure initiatives, giving traders predictable coin flows. Because they contribute to the financial system and are financially strong, infrastructure investments are a precious part of a varied portfolio.

Scarcity of Natural Resources

Certain tangible resources, like uncommon commodities and valuable metals, have a constrained supply. The developing value of those belongings is a result of both delivery constraints and rising global calls. Their enchantment as funding opportunities is better by means of their shortage, which gives the ability for massive returns as the dynamics of delivery and call for exchange.

Sustainable Investing

Investments in renewable energy, environmentally friendly real property, and different sustainable endeavors have surged due to the multiplied consciousness on sustainability and environmental consciousness. These investments support the objectives of being socially conscious and making an investment while having a fantastic environmental effect. Sustainable investment appeals to investors with moral issues because it goes past economic returns and represents a larger cultural shift towards environmentally aware practices.

Preservation of Portfolio During Economic Downturns

During financial downturns, real belongings serve as a buffer. Real property and other tangible belongings are resilient, even though monetary markets are probably more unstable. Particularly, profits-generating residences are able to maintain cash drift even in difficult monetary times. In volatile economic times, this preservation aspect becomes vital for investors looking for portfolio stability and protection.

Tangible Utility and Enjoyment

Beyond their investment value, certain real-world assets, like vacation homes or collectibles, offer tangible utility and enjoyment. In addition to the potential appreciation, investors may get personal satisfaction from using or experiencing these assets. For those who want to invest for both financial returns and personal fulfillment, this emotional and experiential component adds yet another level of value.

How do you invest in real-world assets (RWA)?

Investing in Real World Assets involves setting cash into tangible, bodily belongings like real property, infrastructure, and commodities. Unlike economic assets, which include shares or bonds, RWAs provide intrinsic prices and might offer traders a hedge against inflation. This guide will outline key issues and techniques for those looking to project into the realm of real-world asset funding.

Understanding Real World Assets (RWA)

Real World Assets encompass a diverse variety of investments, including real property, infrastructure, natural resources, and commodities. These belongings vary from financial contraptions like stocks or bonds in that they have intrinsic costs and are, without delay, tied to physical properties.

For example, real property involves proudly owning and managing bodily homes like residential or business homes. Infrastructure investments may consist of initiatives such as roads, bridges, and utilities. Commodities, consisting of valuable metals or agricultural products, also fall under the RWA category.

Methods for Investing in Real-World Assets

Investing in real estate is a famous method where traders select residential or business properties consistent with elements like marketplace demand, place, and increased capacity. It is important to take into account factors like condo yields, asset appreciation, and the possibility of fee-delivered upgrades.

Stable, lengthy-term returns may be obtained from infrastructure investments. Projects touching on software systems, transportation, and renewable energy development are frequently appealing. Public-private partnerships and government initiatives are major forces in this industry.

An additional aspect of RWA investment is provided by commodities. Purchasing agricultural products, gold, silver, or other commodities can function as a hedge against inflation. It is important to stay up to date on supply and demand dynamics, international market traits, and geopolitical issues that could affect commodity charges.

Learn How RWA Investments Benefit You!

The Ultimate Guide for Real-World Asset Tokenization on Blockchain Development

Key Considerations Before Investing

Perform extensive due diligence to determine the risks associated with the particular RWA. Gain an understanding of the market dynamics in which you intend to invest. Local economic indicators, demographic trends, and property demand should be taken into account for real estate investments.

Government policies and global demand are factors that affect commodity investments. As with traditional investing, diversification is a fundamental principle in RWA investment. Spread your investments across various real-world asset types to minimize risk. For instance, you might combine real estate holdings with infrastructure.

Legal and Regulatory Considerations in Real-World Asset Investments

Real-international asset investments are ruled through a complex net of legal guidelines and rules that vary among nations and asset lessons. Investors should realize and navigate those frameworks so that they will ensure compliance and reduce any legal risks associated with their investments.

Real Estate Regulations

There are strict laws controlling zoning, tenancy, land use, and belongings ownership that follow actual property investments. The local legal guidelines that would impact improvement projects, landlord-tenant relationships, and property transactions want to be very well understood by traders. In order to stay out of criminal warm water, constructing codes and environmental policies should be observed.

Commodity Trading Regulations

Trading laws governing commodities, like agricultural products or precious metals, differ internationally. Commodity exchange regulations, trade limitations, and compliance standards must be understood by investors. Regulatory awareness is crucial because international trade agreements and government policies can have an impact on commodity investments.

Approvals for Infrastructure Projects

Government authorities often need to furnish approvals for infrastructure investments. Important factors to keep in mind are constructing lets-in, environmental effect exams, and compliance with safety rules. Public-personal partnership agreements and authorities regulations are important, and traders want to ensure that those agreements are observed, which will stay out of criminal trouble.

Private Equity Compliance

Navigating securities laws, disclosure obligations, and investor protection regulations is necessary when making private equity investments in RWAs. Careful attention ought to be delivered to fund systems in compliance with funding employer guidelines. Know-your-purchaser and anti-cash laundering legal guidelines might also be practiced for non-public fairness investors.

Cross-Border Issues

Since many RWAs entail cross-border transactions, investors must understand and work within various international legal frameworks. The viability and legality of such investments are impacted by means of tax laws, international funding rules, and bilateral agreements. A thorough understanding of the criminal subtleties in diverse jurisdictions is vital for move-border transactions.

Environmental, Social, and Governance (ESG) Compliance

RWA investments are becoming more and more influenced by ESG factors. Corporate governance, social responsibility, and environmental protection regulations are tightening. In order to reduce the risk to their reputation and legal liability, investors must align their strategies with these evolving standards.