Triumph DeFi Development: A Comprehensive Guide to Decentralized Finance Development

The Defi financial development service industry is one of the most critical and time-sensitive industries. It serves as a crucial pillar for society, as it is impossible to think of anything without money. At the same time, it is important to learn about innovative ways of transforming Decentralized financial development services and how people can access them. The problem with traditional financial infrastructures is the lack of accessibility.

More than 2 billion people worldwide are unable to access financial services due to varying requirements such as NFT Marketplace KYC verification and identity management. On the other hand, there are formalities conducted by banks for creating a savings bank account, approving loans, or offering other financial services. In such cases, it is important to think of the plight of billions of people who don’t have access to basic amenities in life, such as food, water, and education.

Billions of people in the world don’t have identity proof, which prevents them from accessing services of banks and financial institutions. Blockchain app development services have come up with an interesting decentralized finance development solution to such problems. The distributed ledger technology ensures the decentralization of finance apps, in which central authorities can no longer determine who will get access to financial services. Almost anyone registered on a blockchain network, in the form of a valid node, could access decentralized financial development services offered by an app on the blockchain app development platform. Decentralized finance development services, or DeFi development services, emerged as a promising solution for resolving the limitations in existing financial systems.

A decentralized finance app development uses blockchain app development technology to offer decentralized access to financial services. Apart from offering better accessibility, DeFi development services also serves as a valuable tool for improving transparency of financial services. DeFi development company offers a broad range of solutions that revolutionize the existing financial services ecosystem.

At the same time, emerging technology trends have served as crucial elements in the growth of DeFi development services. It is also important to know about the prominent challenges for DeFi development services and how you can overcome them. Let us unravel more details about decentralized finance development services solutions in this comprehensive guide to the architecture of the Triumph DeFi app development platform.

What is DEFI App Development?

- From the beginning, the primary focus of blockchain app development technology has revolved around the use of blockchain development services for cryptocurrencies. What is the unique highlight of the DeFi development platform, and how is it diffeent from all types of crypto? The concept of DeFi app development focuses on a collection of financial products that emphasize decentralization and utilize attractive reward mechanisms for encouraging investors. The existing DeFi development platform includes multiple non-custodial financial products focused primarily on highly rewarding and innovative cryptocurrency projects. DeFi development company has successfully garnered the attention of venture capitalists and top companies worldwide by offering exclusive value benefits.

- DeFi development services, or decentralized finance app development, leverage the potential of blockchain app development technology to create a financial ecosystem that allows users to access different financial markets without depending on intermediaries such as banks. On top of it, DeFi development services are different from traditional financial services in that it can facilitate transactions 24/7. It also ensures that transactions are conducted in near real-time without entrusting control to any personnel, authority, or organization. As a result, the DeFi development platform is completely immune to the concerns of a central authority controlling or halting the network at any time.

- Blockchain smart contracts development service serves as the major driving force for the DeFi development company. The self-executing contracts feature the terms of agreement or conditions between seller and buyer scripted directly into the code. Smart contracts development service helps simplify access to financial operations alongside supporting other financial activities such as lending, borrowing, yield farming, and trading.

Difference Between DeFi Development Services and CeFi Development Services

- The best approach for understanding the importance of DeFi development services revolves around comparisons with centralized finance or CeFi. In the case of CeFi, commercial banks take up the central role and offer crucial services such as saving money, providing financial transactions, and lending capital. Centralized finance institutions offer the assurance of an effective track record in performance and security measures. On the other hand, CeFi institutions also exercise control over the assets of users and limitations on the accessibility of certain services.

- DeFi development platform does not present such concerns as it enables direct access to financial services through blockchain software development technology guide. Most important of all, DeFi development platform ensures that users can store their assets with optimal security and enjoy benefits of round-the-clock accessibility. Decentralized finance development services serve as a promising tool for helping the unbanked population with an opportunity to access different financial services.

- DeFi app development platform is open-source in nature, thereby offering adequate support for free collaboration. On the contrary, CeFi works within walled gardens without any opportunity for free collaboration. The open-source nature of the DeFi development platform ensures that it is completely censorship-resistant, while CeFi is subject to the impact of censorship.

- DeFi development company offers cheaper transactions, with most of the expenses focused only on network fees. However, centralized finance is significantly expensive as intermediaries charge a large amount of fees. DeFi development service uses blockchain app development technology, while centralized finance utilizes old and traditional methods.

DeFi Development Platform Market Overview Through Numbers

A detailed impression of DeFi’s development solution on market performance could help you identify why people have to focus on DeFi’s development platform. As of January 2024, the total value locked in DeFi development platforms is $57.633 billion. It is important to note that the TVL in DeFi market protocols has increased by more than five times since July 2020. At the same time, the spending on blockchain app development technology has increased by almost seven times over a four-year period from 2018 to 2022.

Apparently, the spending on blockchain development solutions worldwide will reach $19 billion by 2024. The revenue in the global DeFi market could reach $26 billion in 2024, and it would expand at an annual growth rate of 9.07% over a period ranging from 2024 to 2028. By 2028, the market capitalization of the DeFi landscape would be almost $37 billion.

Statistics For Learning About DeFi Development Services Adoption

Another important aspect you must verify before familiarizing yourself with DeFi principles, advantages, and risks is the status of DeFi adoption. According to Statista, the user penetration rate for DeFi development company in 2024 would be almost 0.25%. The number of users in the DeFi development platform on the market could reach almost 22 million by 2028. It is important to note that the number of DeFi development platform users worldwide in 2022 was 4.8 million. The most common DeFi segment, which has gained formidable recognition in recent times, is decentralized exchanges. DEXs capture 44.5% of the market share in DeFi.

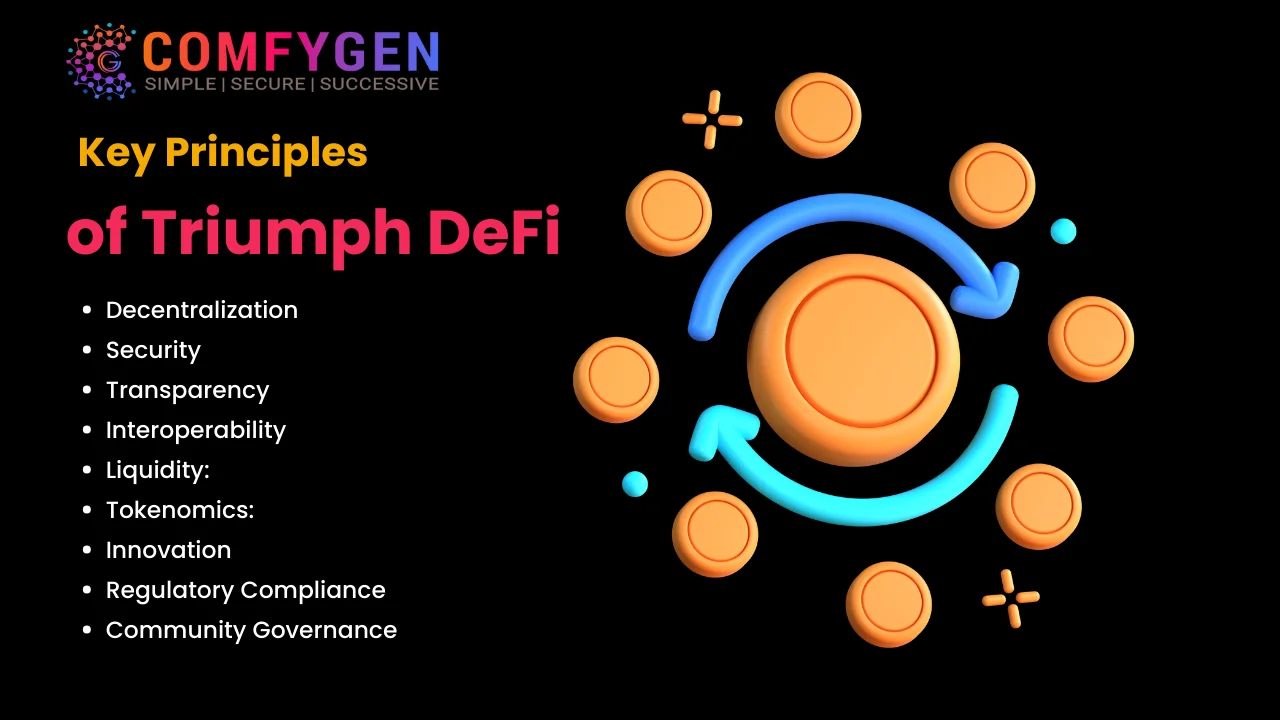

Key Principles of Triumph DeFi App Development

- Triumph DeFi development platform, or TriumphX, aims to offer a cross-chain decentralized finance development platform that allows digitalization and trading of all content in the world. It primarily focuses on unification of the marketplace, thereby helping users trade NFTs on the different blockchains with better transparency and security. TriumphX also serves promising value advantages for the interoperability of different blockchain development platforms alongside combining DeFi development services and NFT marketplace development projects.

- The primary functionalities of any DeFi development service protocol like Triumph DeFi development platform would draw attention toward removal of intermediaries. Some of the key principles underlying the creation of a financial ecosystem in DeFi development solution include transparency, permissionless-ness, decentralization, and open-source nature. With the help of these principles, the DeFi app development platform could work without any central authority and could be accessible to everyone. Therefore, people can leverage the DeFi development service to exercise complete control over their assets, utilize and create dApps, or conduct peer-to-peer transactions.

Discover DeFi Magic - Begin Your Adventure!

Discover DeFi Magic - Begin Your Adventure!

Triumph DeFi Development Platform Architecture

The architecture of the Triumph DeFi development service protocol includes four distinct layers with different components. Four layers of the Triumph DeFi protocol include the blockchain development technology layer, base layer, protocol layer, and service layer. Let us take a look at the individual components and functionality of each layer in the architecture of the Triumph DeFi development service.

Blockchain Layer

The blockchain layer of Triumph DeFi is a parachain developed on the Polkadot network. Polkadot can help in achieving better scalability and interoperability by helping specialized blockchain networks communicate with each other. With the parallelized model of Polkadot, TriumphX can be developed in the form of a parachain that can be compiled into WASM and connected to the Polkadot network. In addition, the Polkadot Relay Chain would also offer cross-chain messaging capabilities alongside the assurance of better security, higher degree of customization, and flexibility.

Base Layer

The base layer in the Triumph DeFi development architecture includes the key components that define the core functionality of the platform. You can find two critical components, such as the TriumphX Smart Contract Extension or TCSE and machine learning. TCSE helps add its own extension to the existing Substrate Blockchain development API and implement Oracle functions in a decentralized manner. Machine learning plays a crucial role in Triumph DeFi by serving use cases in anomaly detection for spotting external attacks.

Protocol Layer

In the protocol layer of Triumph DeFi, you can find a decentralized protocol, “Kabocha.” It can be extended and connected to ensure effortless decentralized applications development or dApps development. TSCE and API help in the management of the protocol, while TriumphX platform works on management of dependency of API libraries. Kabocha protocol has been designed as an open-source platform, thereby allowing anyone to connect to the Triumph DeFi development platform.

Service Layer

The service layer provides a clear connection between different components of the platform and how to offer different services. Some of the notable services offered by the Triumph DeFi development company protocol include fee service, escrow service, digital identity service, Proof of Ownership service, P2P automated market maker, and P2P transaction decision service. In addition, you would also find other services, such as pricing and payment gateway services, as useful additions to the Triumph DeFi or TriumphX protocol.

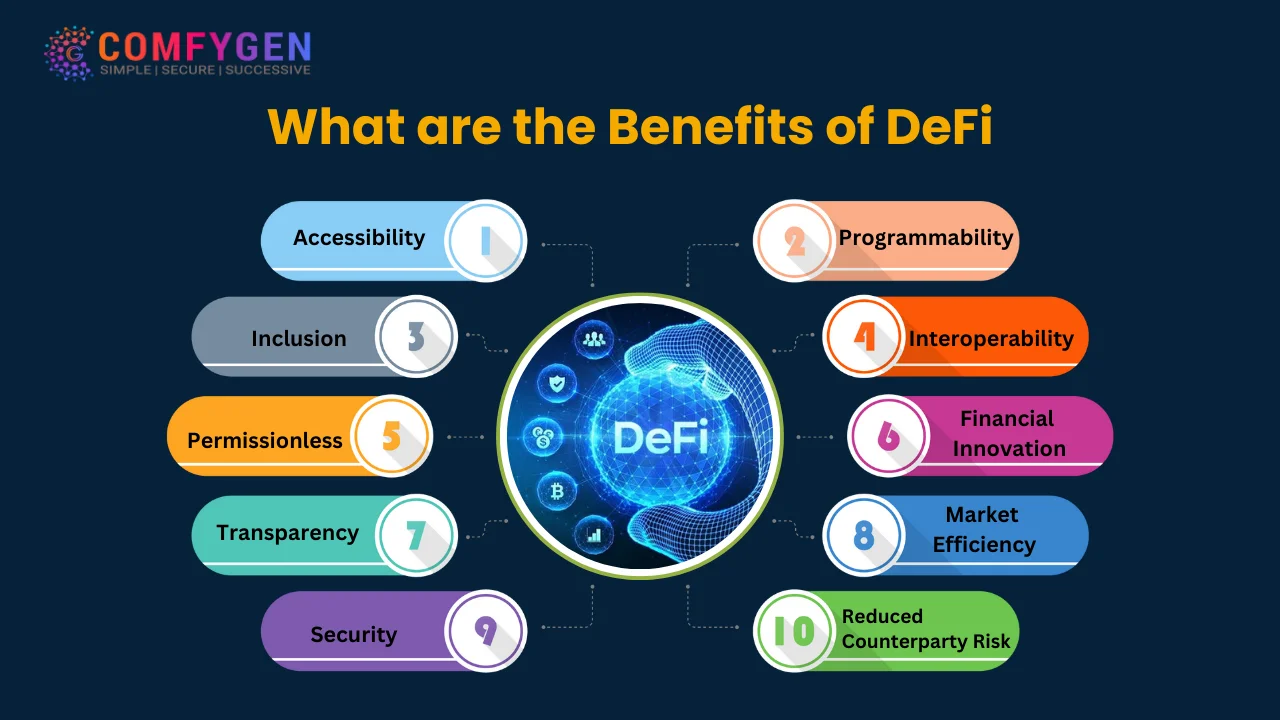

What are the Benefits of DeFi Development Services?

The guides on decentralized finance development services would be incomplete without an outline of the benefits of decentralized finance app development solutions. You can find multiple benefits from DeFi development solutions, such as accessibility, lower costs, security, transparency, decentralization, innovation, immutability, and interoperability.

- The first benefit of the DeFi development service is the assurance of better accessibility of financial services to people who could not access services in the traditional financial system. It can help people who live in areas without any traditional banks or fail to meet essential requirements for accessing financial services.

- DeFi development platform helps in lowering costs by removing intermediaries such as banks, which leads to lower fees and better interest rates. On top of it, transactions can be completed faster without the involvement of intermediaries, thereby improving efficiency and reducing transaction costs.

- DeFi development services use blockchain app development technology to offer the assurance of cryptographic security. At the same time, immutability of blockchain development services ensures that the DeFi development platform is immune to the risks of hacking and fraud. Without any central point of failure on blockchain development services networks, DeFi development services can offer a more secure option for financial transactions and services than conventional financial systems.

- The working of DeFi on blockchain development technology ensures that you can get clear insights into the transactions, codes, and data on the blockchain development platform. With such transparency levels, DeFi development services can garner users’ trust. Almost every user in the network could understand the type of transactions that happen on the blockchain development platform. In addition, transparency also helps in easier audits of transactions alongside verifying authenticity, improving trust and security of DeFi transactions.

- Interoperability is another prominent addition to the value advantages of DeFi development solutions. Within the DeFi ecosystem, Defi developers could create over the existing protocols to ensure interface customization and integration of third-party applications. The flexibility for building over other DeFi protocols also helps in creating new DeFi application development by combining existing DeFi protocols. For example, prediction markets, stablecoins, and decentralized exchanges can be combined to create new and sophisticated DeFi NFT marketplaces. As a result, DeFi development services have emerged as the hotbed for innovation in the domain of financial services.

- DeFi development company offers the most important benefit of control in the hands of users. With the value of decentralization, DeFi development solutions ensure that users have complete control over their financial transactions.

What Are The Risks Associated With DeFi App Development?

The risks associated with DeFi applications would also have a major impact on how you utilize decentralized finance development services and solutions. Some of the most notable risks for DeFi development include defi smart contract development services risks, security defi development services risks, liquidity defi development services risks, regulatory defi development services risks, and market of defi development services risks. Here is an overview of the implications of different security defi development services risks with DeFi application development services.

Smart Contract Risks

DeFi applications are developed by utilizing blockchain development technology and leverage smart contract development services for the automation of financial transactions. Smart contract development solutions are self-executing contracts that include the terms of agreement between sellers and buyers. On the other hand, smart contract development is also vulnerable to bugs, hacking attempts, and errors, which could lead to loss of funds.

Market Risks

DeFi markets are also vulnerable to market risks like traditional financial markets. Some of the notable market risks include market volatility, sudden variations in market conditions, and price fluctuations. The market risks can lead to significant losses for investors who have limited preparation for managing the risks.

Liquidity Risks

The list of problems with DeFi development solution also points to liquidity risks. Defi development services are still in the initial stages of development, which suggests that most of them have low liquidity. Barring the popular protocols, it is difficult to sell or buy specific assets on all DeFi development platforms, thereby leading to rapid price fluctuations. On top of it, DeFi protocols do not have the ideal liquidity management mechanisms. As a result, they can face liquidity issues leading to loss of funds

Security Risks

The notable security risks for DeFi protocols include phishing, hacking, and other types of cyber-attacks. DeFi app development platform users must keep an eye out for such risks to safeguard their assets by avoiding phishing scams through comprehensive research or using secure wallets.

Regulatory Risks

Decentralized finance is a trusted decentralized system operating outside the traditional financial regulations. With the lack of regulations, DeFi development platforms are vulnerable to the risks of fraud, money laundering, and other illegal activities. On top of it, governments all over the world have been taking an interest in DeFi services and could come up with regulations that can have a negative impact on DeFi.

How Can You Make Money With DeFi App Development?

You can make money with DeFi development services by having the right things in place. First of all, you would need a crypto wallet that supports Ethereum blockchain development services and could connect to the different DeFi protocols through the browser. You should also have the relevant coin or token for the DeFi protocol you want to use. Then, you can start playing the DeFi game by adopting different approaches.

- The first approach involves lending out cryptocurrency or yield farming through adding liquidity in DeFi protocols in return for governance tokens. You can also place your funds in the cryptocurrency exchange and earn rewards by serving the role of an Automated Market Maker.

- Another important way to make money with DeFi app development services is to try new and innovative DeFi app development projects. However, you should also keep an eye on scams and potential vulnerabilities.

User Adoption Strategies

The ideal strategies for user adoption in the domain of DeFi development services revolve around experimentation and awareness. You can find multiple DeFi development platforms, including Uniswap, MakerDAO, Aave, and Compound. The best way to identify a suitable DeFi app development platform is comprehensive research that helps in choosing a platform suited to your needs.

After you have selected the platform, you can begin using the platform and explore its different functionalities. Users can adopt the DeFi development solution as an essential component in the web3 ecosystem, thereby ensuring their readiness for the future. However, the user adoption strategies for DeFi development services revolve primarily around the value advantages and improving awareness regarding the DeFi development platform.

Future Trends and Innovations

The review of the potential advantages of the DeFi development platform also invites attention to the new trends expected in the industry. DeFi development services can help empower global financial inclusion by offering financial service accessibility to the unbanked population. The most important trends in the future of DeFi app development solutions would revolve around the democratization of access to financial services.

In addition, DeFi app development solutions could also open the scope for developing new financial products alongside leveraging the power of interoperable transfer of assets and functioning of financial services across different blockchain development platforms. Another notable trend in the future of DeFi development services points to the possibility of growth in regulatory impact. Technological innovations would primarily focus on the rise of web3 technologies and possibilities for combining NFTs marketplace development services and DeFi development services to unlock new NFT utilities.

Secure Your Future - Let's Plan Together!

Secure Your Future - Let's Plan Together!

Conclusion

The arrival of decentralized finance development services serves as a revolutionary milestone in the domain of financial services. Accessibility of financial services can be influenced by utilizing blockchain app development technology to create DeFi development solutions. Interestingly, DeFi app development solutions are not limited to offering only one type of financial service.

You can explore different types of traditional financial services in a completely new way with the DeFi app development platform. The value advantages of decentralization application development services, immutability, interoperability, cryptographic security, and innovation would help in empowering the adoption of DeFi development services in the future. On top of it, the growing interest in web3 is also a major aspect that would play in favor of the adoption of DeFi app development platform.

FAQ title

FAQ description

What are the best practices for securing DeFi assets?

The best practices for security of DeFi assets involve using a hardware wallet, installing all the necessary updates, and conducting in-depth research of wallet and contract addresses before interacting with them.

What are the examples of popular DeFi platforms?

Some of the popular DeFi platforms in the market right now include Uniswap, Compound, Aave, and MakerDAO. Each platform serves a distinct functionality and offers unique advantages. For example, Uniswap serves as a decentralized exchange, while Aave and Compound are crypto lending platforms.

What are the notable risks for DeFi?

The common risks for DeFi include smart contract risks, security risks, liquidity risks, market risks, and regulatory risks. Awareness of the different types of risks for DeFi helps in making informed decisions with insights regarding latest innovations and developments in the DeFi ecosystem.

FAQ title

What are the best practices for securing DeFi assets?

What are the examples of popular DeFi platforms?

What are the notable risks for DeFi?

Comfygen Private Limited